Introduction

Investing can be intimidating, particularly for people who are unfamiliar with the financial world. Mutual funds provide a workable answer by combining the assets of several participants to produce a diverse portfolio. This book will assist you in comprehending the fundamentals of mutual funds, their advantages and disadvantages, and how to choose the best ones for your financial objectives.

Understanding Mutual Funds

Investment vehicles known as mutual funds pool the capital of several participants to purchase a variety of stocks, bonds, and other securities. Professional fund managers oversee them, making choices on investments on the investors’ behalf.

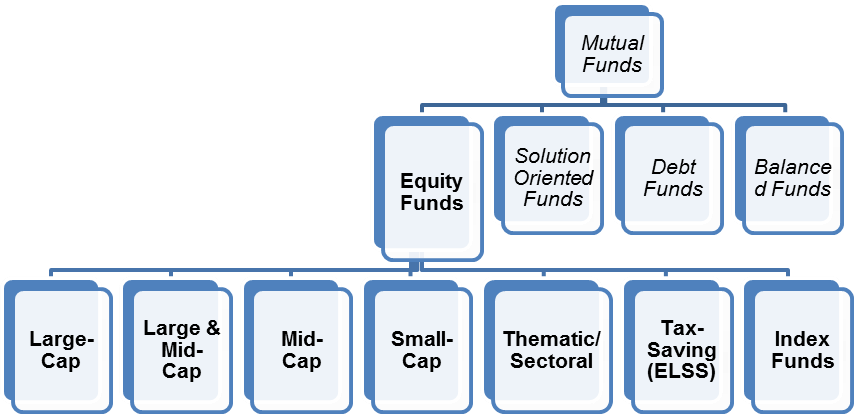

Types of Mutual Funds:

- Equity funds: Invest mostly in equities, which carry a higher risk but have the potential for large profits.

- Debt funds: Make investments in fixed-income assets, which offer lower risk and more consistent returns.

- Hybrid funds: For a balanced risk and return, combine debt and equity investments.

- Index funds: These passive investment vehicles follow a particular market index.

Benefits of Investing in Mutual Funds

- Diversification: Mutual funds spread investments across various assets, reducing the impact of a poor-performing investment.

- Professional Management: By managing the portfolio and analyzing market movements, fund managers save investors’ time and effort.

- Liquidity: The majority of mutual funds facilitate easy share purchases and sales, giving investors access to cash when needed.

- Affordability: A wide variety of investors can access mutual funds due to their cheap minimum investment requirements.

Risks Associated with Mutual Funds

Investing in mutual funds carries certain risks, including:

- Market Risk: Depending on the state of the market, the fund’s value may change.

- Credit Risk: Fund performance may be impacted by bond issuer defaults.

- Interest Rate Risk: Bond funds in particular may be impacted by changes in interest rates.

Understanding these risks is crucial for making informed investment decisions.

How to Choose the Right Mutual Fund

Choosing the right mutual fund involves:

- Evaluating Investment Goals: Establish your risk tolerance and time horizon.

- Evaluating Performance: Review past performance, though past results do not guarantee future returns.

- Considering Fees: Analyze expense ratios and any additional fees that may impact returns.

- Researching Fund Managers: Look into the experience and track record of the fund management team.

Investment Strategies

- Systematic Investment Plans (SIPs): Invest a fixed amount regularly, which can help mitigate market volatility.

- Lump Sum Investments: Invest a large sum at once, suitable for those with a higher risk tolerance.

- Long-Term vs. Short-Term: Focus on long-term growth to ride out market fluctuations.

Tax Implications of Mutual Funds

Maximizing returns requires an understanding of the tax ramifications. When selling fund shares, capital gains tax may be applicable, and different mutual funds have different tax treatment.